Integrated Business Planning (IBP) has the potential to be a significant value driver in global manufacturers. However, most fail to realize this value. Primarily because they don’t design their processes to evolve into mature forms of IBP. Instead, their processes never evolve beyond traditional sales and operations planning (S&OP). What’s more, these processes still aren’t integrated with finance, resulting in key challenges that still face both functions. As a result, manufacturers are stuck with outdated processes that don’t fully support strategies like profitable growth, operational excellence, customer engagement and digital transformation.

The article looks at IBP as part of broader set of integrated planning & performance management (P&PM) processes. It presents five recommendations to help global manufacturers avoid common missteps that contribute to this situation.

-

-

- First, Finance should own Integrated Business Planning.

- Second, evaluate Financial & Operational P&PM processes & software together.

- Third, define key changes that underlie the value of integrated P&PM processes.

- Fourth, design P&PM processes first before considering the purchase of any software.

- Fifth, develop an integrated implementation plan.

-

Details of these recommendations are described below. This article also makes reference to four other articles [that I wrote for FP&A Trends] that are shown below in Exhibit 1. Article 2 can be accessed by clicking here. Links to the other 3 are provided at the bottom of Article 2 on the FP&A Trends site.

1) Finance Should Own Integrated Business Planning

Many global manufacturers were early adopters of strategic Corporate Performance Management (CPM) tools that support financial planning, budgeting and reporting processes. What’s now being recognized is that these financial tools don’t always meet the needs of global manufacturers. For example, most lack the ability to support:

-

-

- Scenario planning processes that can simultaneously expose financial and operational risks, while also identifying optimal responses.

- Accurate cash flow, working capital and foreign currency exposure forecasting that are based on an operationally realistic view of inventory balances and movement.

- Mature forms of rolling forecasts and driver-based planning, specific details of which can be found in Article 3, of Exhibit 1.

- Effective cross functional alignment that eliminate functional silos, further details of which can be found in Article 4, of Exhibit 1.

-

One reason for this conclusion is that no strategic CPM vendor supports prescriptive analytics – tools that support mature forms of driver-based planning. What’s being recognized is that prescriptive analytics [a form of which is supply chain optimization] tools are needed to support these processes. This means that these prescriptive analytics tools must meet the needs of both finance and operations. The same can be said of demand forecasting (also called predictive analytics) as part of the revenue planning process.

In light of the above, forward thinking CFOs now see IBP as a key component of financial planning, budgeting and forecasting processes. As a result, IBP is viewed as a finance process that needs to be jointly developed and shared with operations. With Finance leading it, they can inject the type of financial rigor that so many IBP processes lack.

A key part of taking this leadership role entails viewing and defining IBP more broadly. This means looking beyond tactical definitions that remain rooted in rooted in S&OP and supply chain. For example, I define integrated P&PM as follows:

Establishing such a definition will go a long way towards eliminating the confusion caused by endless “integration terms” that are used so liberally in the market place, some of which are summarized in Article 2, of Exhibit 1.

2) Evaluate Financial & Operational P&PM Processes & Software Together

When IBP programs go off track, problems can often be linked to one incorrect assumption that is often made in software selection. That being that the combination of leading IBP and leading strategic CPM tools will result in a mature P&PM process. Note that “leading” is a term used by certain technology analysts.

One thing must be remembered about the market positioning provided by technology analysts. It is functionally oriented! There is one for Finance and one for Operations / S&OP. They don’t evaluate tools in terms of their ability to support mature forms of integrated P&PM processes.

When viewed from a broader process perspective, a different picture emerges. One that exposes key capability gaps in both S&OP and strategic CPM software tools. What’s also exposed are weaknesses in these traditional approaches to evaluating [financial and operational] software companies.

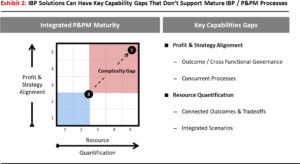

The problem with these traditional methods is that critical capabilities fall between the cracks of financial and operational technology evaluations. For example, four such capability gaps are shown below in Exhibit 2 and explained further in Article 1, of Exhibit 1. This gap [between what global manufacturers need and what software companies provide] is illustrated described by the difference between points X and Y.

The key takeaway from this point is that financial and operational executives need to understand the capabilities that comprise mature forms of P&PM processes. This article, along with the four shown in Exhibit 2, provide a starting point for understanding them. By doing so, you’ll be able to identify the gaps that prevent manufacturers from achieving their objectives. You’ll also be able to avoid the missteps of others, as Article 2 [of Exhibit 1] summarizes one company’s experience concerning the assumption about its use of “Leading” IBP and strategic CPM tools.

3) Define Key Changes That Underlie The Value of Integrated P&PM Processes

Ultimately, the value of mature forms of integrated P&PM processes [aka IBP] lies in the ability to quickly reallocate resources [across functions and entities] in response to changing market demand and business objectives and targets. One factor, more than any other, undermines the ability to realize this value: functional silos. In fact, functional silos – not just data silos – undermine virtually every strategy that global manufacturers purse. See Article 2, of Exhibit 1, for further details.

One of the primary causes of these silos are functionally-based budgeting and rolling forecast processes. An effective IBP program must recognize the need to change these processes to enable cross functional target setting and resource allocation. And in the process, reduce the cost of complexity, an amount that can reach 5% of sales. See Article 1, of Exhibit 1, for further details about the value of mature IBP processes.

Another reason for changing these financial processes is the need to eliminate behaviors that undermine IBP effectiveness. These behaviors are caused by unwritten rules like “never submit your real budget the first time” or “always under promise and over deliver”. In most cases, these rules are a direct result of functionally-based and fragmented budgeting and target setting processes. See Article 1, of Exhibit 1, for further details about this.

The key message here is that mature forms of integrated P&PM processes cannot be achieved without changes to financial planning, budgeting and forecasting processes. While such changes are often made in later stages of IBP programs, the requirements to support them should be known early on. Experience shows that designing S&OP / IBP processes, without re-engineering financial processes at the outset, is typically a formula for failure.

The key message here is end to end financial and operational processes, together with required changes, should be define at the outset. These changes should also be part of a broader vision for integrated P&PM processes and the finance function itself. Some refer to this as the blueprint for Finance Transformation.

4) Design P&PM Processes First Before Considering the Purchase of Any Software

In mature software markets, like ERP, organizations can select a vendor with the intention of adopting the processes that they support. Some believe that the S&OP / IBP markets are analogous to ERP. But this is not the case. Selecting a vendor, before defining processes, can have disastrous consequences. While vendors may support S&OP, many are far removed from mature IBP / P&PM processes. Nor do they support a path to get there.

In light of this, manufacturers should deign their processes first. This doesn’t mean a classic four of five step S&OP process with review meetings. It means detailed flow charts with defined activities, inputs and outputs. As the owner of the process, Finance should look for the following key process features that comprise mature IBP processes:

-

-

- There should be no distinction between financial and operational processes. In other words, S&OP and rolling forecasts should be the same process – one having a cadence that meets the needs of all stakeholders.

- Cash flow, inventory, work capital and foreign currency exposure forecasting should be a by product of the process.

- Integrated scenarios should be supported that can simultaneously expose financial and operational risks, while also identifying optimal responses. What’s more, the process should enable selected scenarios to be quickly deployed in the process.

- Integrated Reconciliation should be automated, where price, volume, mix, productivity, unit cost variances are automatically calculated for differences between any combination of budget, actual, forecast and scenario.

-

Armed with requirements stemming from detailed process definitions, manufacturers can make informed decisions about financial and operational software vendors that can support mature forms of integrated P&PM processes.

5) Develop an Integrated Implementation Plan

One thing should be remembered about the implementation of mature P&PM processes. They are never implemented all at once. They are phased in over longer periods of time as organizations develop the necessary models, processes and skills. The implementation plan should have key milestones that define how these capabilities will be phased in over time.

A key part of this plan requires the development of new skills for both financial and operational professionals. Finance professionals will need to become more operationally savvy, while operational employees need to better understand Finance. Development of these skills should start at the outset of the project. Both need to understand how mature [forms of] integrated P&PM processes will help them address key management challenges. While also enabling them to more effectively contribute to strategy execution and value creation.