Strategic Corporate Performance Management (CPM) is a type of software that helps organizations to automate financial planning, budgeting, forecasting, reporting, measurement and strategy management processes. Two capabilities promoted by strategic CPM vendors are rolling forecasts and driver-based planning, the latter being an approach that derives financial forecasts from operational activity volumes, or drivers. Global manufacturers have unique requirements for mature forms of these capabilities. However, strategic CPM tools typically don’t support them. This two-part article describes these gaps by focusing on the absence of:

-

-

-

-

-

- Manufacturing logic, in Part 1 (click here)

- Prescriptive Analytics, in Part 2 (see below)

-

-

-

-

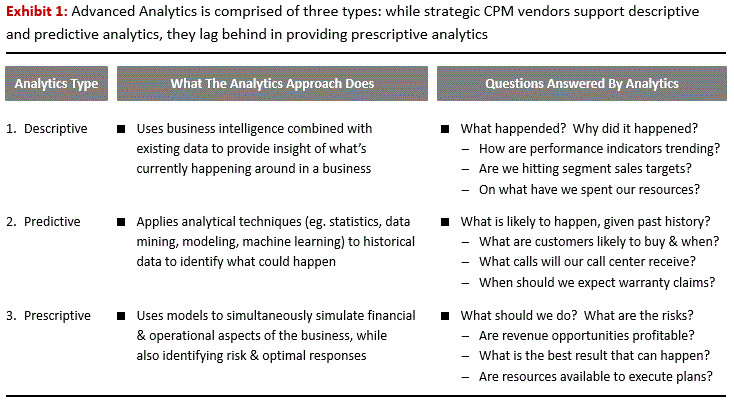

Strategic CPM software companies typically provide different forms of advanced analytics to support financial processes, definitions for which are provided in exhibit 1. Most provide descriptive analytics – the most basic and common form. Some provide predictive analytics, especially in support of demand planning. But the vast majority don’t support Prescriptive Analytics that are embedded into financial processes.

In simple terms, Prescriptive Analytics is a mature form of driver-based planning. A more formal definition would be a form of analytics that quantifies the best outcome among different choices. Prescriptive Analytics enable companies to answer two interrelated questions. What should we do and what are the risks? These tools use mathematical modeling techniques (eg. optimization, simulation) to quantify financial and operational resource requirements, given different priorities, constraints and assumptions about things like revenue, mix, and service levels.

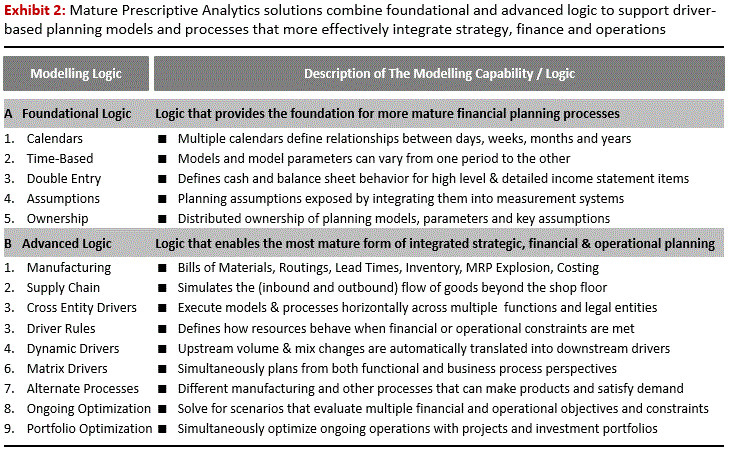

Strategic sourcing provides a classic illustration of the difference between these types of analytics. Descriptive analytics can be used to determine the quantity and value of vendor purchases in the past. Predictive analytics can determine potential demand for products, while Prescriptive Analytics can quantify the impact of sourcing changes. For example, it can quantify how sourcing decisions affect (direct and indirect) costs, profits, direct cash flow, foreign currency exposure, operational capacity and inventory investment, across multiple functions and legal entities. Strategic CPM tools can’t support this kind of forward looking analysis because they don’t always support the modeling logic shown in Exhibit 2.

Foundational logic can be found in some newer strategic CPM tools. The advanced logic comprises some of the key capabilities that separate strategic CPM tools from planning applications that leverage prescriptive analytics. Dynamic drivers, for example, arise from models that can simulate the flow of goods and services that comprise customer value propositions, across multiple functions and legal entities. These “flow-based” models have historically been applied to supply chain modeling. However, they can also be used to automatically:

-

-

-

-

-

- Adjust downstream driver volumes for changes in volume and mix. For example, change the mix of customer returns based on changes in order mix.

- Calculate costs and cash flows, from both functional and business processes perspectives. For example, calculate the total cost of order to cash process, along with the component costs and volumes for underlying segments.

- Apply resource consumption and allocation rules as financial and / or operational constraints are met. For example, when overtime is more than 10% of standard, incorporate a new shift, along with the associated start up costs.

-

-

-

-

In global manufacturers, this modeling logic supports vastly superior scenario planning processes in comparison to strategic CPM tools because financial and operational forecasts remain accurate across a wide spectrum of supply and demand scenarios. What’s more, they provide the means to optimize resource allocation by more effectively coping with interconnected trade-offs that govern enterprise performance. In fact, the absence of such logic (from strategic CPM tools) is also one of the primary reasons why finance executives struggle to improve forecast accuracy, cash flow forecasting, rolling forecasts and cost and profitability management.

In global manufacturers, the absence of Prescriptive Analytics leaves strategic CPM tools unable to drive substantive business value and meaningful improvements to financial planning, budgeting, forecasting, and performance management processes

Prescriptive Analytics software is not new. Supply chain software companies have provided forms of it for years. They have a long history of creating $ Billions in insight-driven value, by optimizing interconnected trade-offs across supply chains spanning multiple functions and legal entities. However, these tools have done little to help manufacturers sustain this value. Four factors account for this:

-

-

-

- First, these tools are typically designed to meet Operational needs, resulting in capability gaps that preclude their use in Financial processes.

- Second, many of tools have limited process execution capabilities, such as work flows, alerts and issue management. As a result, their ability to support meaningful improvements to financial planning and performance management processes is limited.

- Third, these tools typically lack the ability to effectively maintain models. For example, effective master data management capabilities are typically missing parameters can become dated, leading to results that are incomplete and inaccurate.

- Fourth, these tools weren’t made in a way that makes it easier for companies to grow into over time. For example, starting with basic driver models, adding manufacturing logic and then evolving into optimization and other logic shown in Exhibit 2.

-

-

The consequence of these gaps is that Prescriptive Analytics hasn’t been effectively integrated into financial planning, budgeting forecasting and performance management processes. As a result, strategic, financial and operational processes remain fragmented, thereby preventing effective changes to target setting, resource allocation and reward and recognition – the processes that are central to sustaining this insight-driven value.

Newer and more innovative software solutions are emerging to address these capability gaps. In so doing, they enable superior planning and performance management processes (compared to legacy strategic CPM tools) because they enable more effective strategic, financial and operational integration. These technology innovations are described in separate LinkedIn post entitled, “Finance In Global Manufacturers: Why Strategic CPM Software Could Soon Be Obsolete – Implications For FP&A and Treasury Executives“.

The key takeaway from this article is that Prescriptive Analytics needs to be a key focus for Financial Planning and Analysis (FP&A) executives in global manufacturers. Not as a stand-alone tool. But as an embedded capability that supports mature processes that bring together strategy, finance and operations. What will result are processes that enable manufacturers to more effectively manage complexity – a capability that I described in separate LinkedIn post entitled “Finance In Global Manufacturers: How FP&A Can Improve Profits By Up To 5% Of Sales Through Effective Complexity Management”.

I welcome comments and opportunities to discuss these points of view. To this end, please feel free to connect with me and join the IBP Collaborative LinkedIn group, a key focus of which is on planning and performance management innovations and interconnected (strategic, financial and operational) issues in companies that manufacture and distribute goods. Also, check out our YouTube Channel for further details about the perspectives contained in this and other LinkedIn posts.