Strategic Corporate Performance Management (CPM) is a type of software that helps organizations to automate financial planning, budgeting, forecasting, reporting, measurement and strategy management processes. In smaller and less complex companies, these tools play an important role in improving how organizations plan and manage their business.

In global manufacturers, however, this isn’t always the case. In fact, strategic CPM tools often fall short in supporting the aspirations of forward-thinking CFOs. Especially in organizations where Financial Planning and Analysis (FP&A) functions seek to become more effective business partners that can play a leading role in driving transformation efforts. The problem: they often lack critical capabilities that are important for coping with the complexities of global manufacturers.

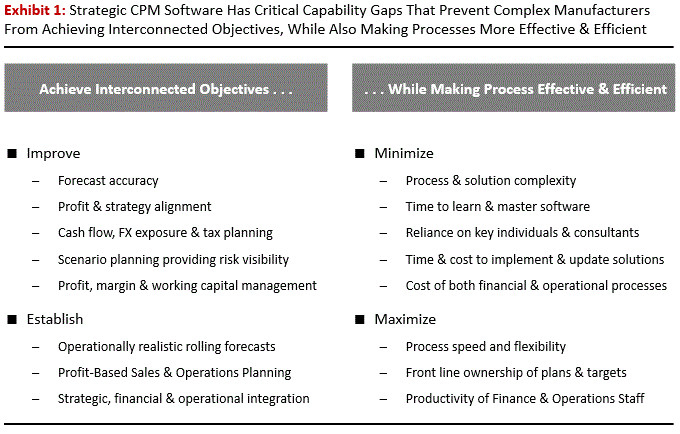

If you’re an FP&A executive that’s an experienced user of older / legacy strategic CPM software, chances are you’ve already come to this conclusion. While you’re satisfied with basic budgeting, reporting, consolidation and dashboard capabilities, you’re probably having difficulty using strategic CPM tools to achieve more complex and interconnected objectives, like those shown in exhibit 1 below. And doing so, while also making planning and performance management processes more effective and efficient.

Treasurers have had similar experiences with processes supported by these tools. Cash flow, foreign currency exposure and working capital forecasting processes continue to be fragmented, slow and unable to support effective and operationally realistic scenario planning that can expose treasury-related risks.

Many newer, cloud-based strategic CPM vendors see the limitations of their older rivals. In fact, some have marketing campaigns that are specifically focused on pointing them out. However, they often have many of the same shortcomings. While cloud solutions may address certain shortcomings of legacy tools, they don’t always offer meaningful solutions to the issues noted above. They, like their legacy counterparts, can’t always fully support two objectives:

-

-

- Resource Quantification: Quickly & accurately quantify financial & operational resources that support desired revenue, profit, cost, service & quality targets, across multiple functions & entities.

- Strategy & Profit Alignment: Quickly reset targets and rewards, while reallocating resources across functions and entities to fund objectives and optimize operating results and project portfolio ROI.

-

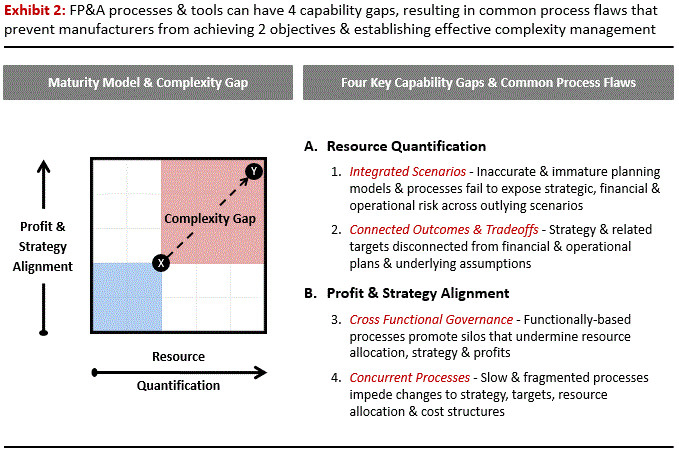

The problem is that strategic CPM tools often have four capability gaps that prevent them from fully supporting these two objectives. These capabilities, which are essential for effective complexity management, are shown below in Exhibit 2.

Some tools may partly address these gaps within single entities. But doing so across multiple functions and legal entities imposes complexities that few are equipped to handle. Further details this perspective, as well as the exhibit shown above, are provided in the (7 minute) YouTube video shown below, along with other videos in the playlist to which this one belongs.

As little as a few years ago, writing about capability gaps in strategic CPM tools would have been pointless because meaningful alternatives didn’t exist. But this has changed, as manufacturing-specific technology innovations are now addressing these gaps. I wrote about these innovations in separate post entitled, “Finance In Global Manufacturers: Why Strategic CPM Software Could Soon Be Obsolete – Implications For FP&A and Treasury Executives“

These innovations provide the means to more effectively integrate strategic, financial and operational planning and performance management processes. In so doing, they enable step change improvements in the ability to plan and manage the performance manufacturing organizations. I wrote about this value in separate post entitled, “Finance In Global Manufacturers: How FP&A Can Improve Profits By Up To 5% Of Sales Through Effective Complexity Management“

The key takeaway from this article is that Finance executives need to understand the relevance of these innovations to the planning and performance management processes in manufacturing companies. Not only will they be able to develop these processes faster and more cost effectively, but they’ll be to do so in a way that avoids that the gaps and challenges that so many continue to experience.

I always welcome comments and opportunities to discuss these points of view. To this end, please feel free to connect with me and join the IBP Collaborative LinkedIn group, a key focus of which is on planning and performance management innovations and interconnected (strategic, financial and operational) issues with manufacturing and / or supply chain companies. Also, check out our YouTube Channel for further details about the perspectives contained in this and other LinkedIn posts.