It is said that a picture is worth a thousand words. In the case of the one above, it is especially true of how Financial Planning and Analysis (FP&A) executives can drive significant value for large manufacturers. How? By enabling them to avoid unintended consequences of decisions (and non decisions) that erode value. In other words, by enabling manufacturers to more effectively manage complexity.

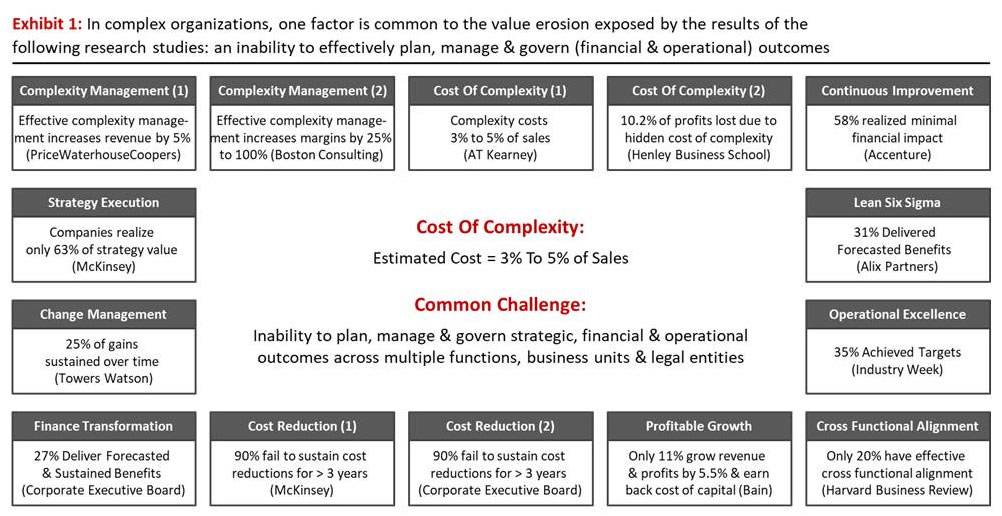

Research consistently shows that managing complexity is a key concern of global CEOs. And for good reason! The cost of complexity can be significant – upwards of 5% of sales. Moreover, it’s a pervasive problem that erodes value in different ways, as illustrated below in Exhibit 1.

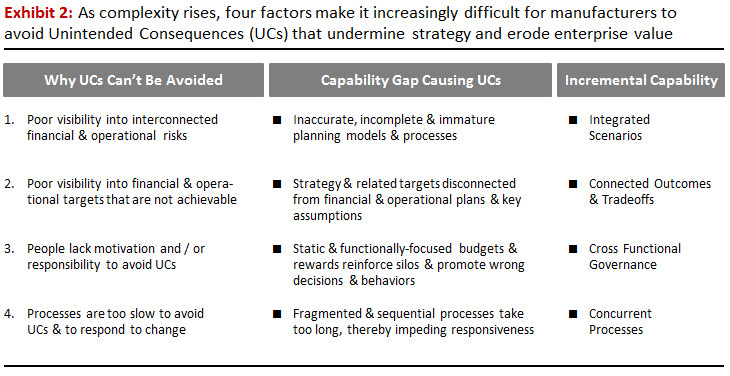

The different forms of value erosion represented by these research results all stem from one common challenge. That being, an inability to effectively plan, manage and govern outcomes, across multiple functions, business units and legal entities. As complexity rises, four factors make it increasingly difficult for manufacturers to avoid unintended consequences that undermine strategy and erode value. These factors, along with the capability gaps that cause them, are illustrated in Exhibit 2 below.

As little as a few years ago, technologies didn’t exist that could effectively address these gaps. But this has changed, as manufacturing-specific technology innovations provide four incremental capabilities that strategic Corporate Performance Management (CPM) and Sales and Operations Planning (S&OP) tools do not. I wrote about these innovations in separate article entitled, “Finance In Global Manufacturers: Why Strategic CPM Could Soon Be Obsolete – Implications For Selecting Financial Planning & Performance Management Software”. These innovations are further explained in the (7 minute) video shown below”.

Establishing these four capabilities will become increasingly important for FP&A executives that seek to become more effective business partners. This is because they provide the means to create significant business value by helping manufacturers to avoid unintended consequences of complex decisions.

The key take away from this article is that Finance and FP&A executives need to develop a deeper understanding of the processes that these innovations support and how they differ from a) the ones that they have now, and b) the ones that could be supported by existing legacy tools. In this way, they will be in a better position to recognize the potential value that stems from processes that support more effective complexity management.

I welcome comments and opportunities to discuss these points of view. To this end, please feel free to connect with me and join the IBP Collaborative LinkedIn group, the name of which is “Managing Complexity In Global Manufacturers Through Strategic, Financial & Operational Integration”. Also, check out our YouTube Channel for further details about the perspectives contained in this and other LinkedIn posts.