This article describes four critical capabilities that are missing from the processes that global manufacturers (GMs) use to plan, manage and govern their business, especially from Integrated Business Planning (IBP) processes. The capabilities result from fully integrating (strategic, financial and operational) planning and performance management (P&PM) processes. Collectively, these capabilities enable effective complexity management, an essential competency for superior strategy execution and value creation in global settings. These “complexity management capabilities” are summarized below in Exhibit 1, along with the business issues and capability gaps that they address:

Each of these capabilities are described in the sections that follow.

Capability 1: Productivity & Matrix Management Enabling Cross Functional Alignment

Research consistently shows that functional silos – not data silos – remain one of the greatest barriers to strategy execution. They persist because functions and entities remain the primary focus of financial processes. Particularly budgeting, a process known to reinforce silos.

IBP is often described as a cross functional process that enables greater collaboration. Ironically, one of the most significant flaws of IBP processes is that they don’t break down functional silos. While they may address data silos, they do little to create effective alignment around optimizing cross functional outcomes.

This is important to understand for two reasons. First, the underlying value of IBP is based on the ability to quickly reallocate resources across functions and entities. Silos, and fixed functional budgets that cause them, prevent this free flow of resources. Second, they also undermine most strategies pursued by GMs, like operational excellence and customer relationships.

To illustrate this gap, consider the example of an order to cash process. Who in your organization owns the metrics perfect order fulfillment, cost per order and days in accounts receivable? And who has decision rights [that allow them] to make required [functional and process] changes to achieve targets for these metrics? The answer in most GMs is no one. One factor, more than any other, prevents GMs from rectifying this governance challenge. That being the absence of alignment mechanisms, like those illustrated below in Exhibit 2.

Collectively, these mechanisms provide the means to focus people on broader process objectives, rather than those of individual functions. This is achieved by rewarding people based on achieving [cost, service and quality] targets for business processes, like illustrated in Exhibit 2.2, rather than those of individual functions and activities that comprise them. Such alignment is especially important for GMs, as multiple legal entities routinely enable the processes and supply chains supporting customer value propositions.

Capability 2: Outcome & Tradeoff Management

Mature IBP processes align outcomes with profits. They do this by enabling GMs to plan, manage and govern objectives that often conflict with one another, including:

-

-

-

- Increasing customer satisfaction / retention, while also improving profits and cash flow

- Reducing costs and inventories, while simultaneously delivering exceptional service and quality

- Optimizing performance of functions and business units, while doing likewise for GMs as a whole

-

-

These tradeoffs [between cost, service and quality] affect virtually every aspect of enterprise performance. However, GMs don’t always manage them well. One reason is that IBP / P&PM processes lack formal capabilities for doing so. What’s required are consistent definitions of what these outcomes and tradeoffs are, an example of which is illustrated below in Exhibit 3.

When embedded into IBP processes, this outcome hierarchy addresses one challenge that is highly relevant to CEOs and business unit leaders of GMs. That being, no one person or team is accountable for the outcomes and tradeoffs shown in levels 2 and 3 of Exhibit 3. What this means is that GMs have ineffective accountabilities for inventory levels and profits.

Here’s why. In complex GMs overhead costs become a larger part of cost structures. The activities causing these overhead costs become an important part of customer value propositions. Especially for those pursuing digital strategies. What this means is that decisions about inventory levels cannot be made in isolation of those for customer service activities and costs.

Supporting such an approach goes beyond just measuring tradeoffs. GMs must be able to plan them as well. After all, you can’t govern what you can’t plan. This requires [cross functional] planning model and process execution capabilities that translate customer-related tradeoff targets into those for the products and processes that support them. Not only does the absence of such capabilities undermine the maturity of sales and operations planning, it does likewise for other management methods like balanced scorecard, activity-based costing and rolling forecasts.

Capability 3: Integrated Scenarios Enabled By Prescriptive Analytics

Research consistently shows that scenario planning remains a significant challenge for GMs, even for those companies that have invested in S&OP, supply chain optimization. and financial planning and budgeting tools. While these tools may support aspects of scenario planning, many still can’t do the following:

-

-

-

- Accurately project financial and operational resources and cash flows

- Simultaneously expose and optimally resolve SFO risks and constraints

- Quantify the volume and mix of products and services that optimizes cash flow

- Quickly execute scores of “end-to-end” scenarios across functions and entities

- Support the outcome-based approaches illustrated by Exhibits 2 and 3

-

-

Prescriptive analytics is a type of planning model that supports such capabilities. It has modeling logic that enables a realistic representation of a business, which includes the following:

-

-

-

- Inventory, MRP and lead time logic

- Business rule logic for coping with constraints for specific activities

- Step change cost functions and the point at which they are applied

- Model parameters that vary based on master data attributes

- Cash flow logic applied to any combination of master data attribute

- Dynamic drivers, where changes to the mix of upstream activities automatically translated to downstream activities

-

-

Prescriptive analytics models are not new, as supply chain optimization tools have been available for years. What is new are modeling and process execution platforms that address the limitations of traditional supply chain tools. This includes:

-

-

-

- Modeling the entire enterprise, not just the supply chain and individual entities

- Distributing ownership of parameters to quickly update models for business changes

- Maintaining analytical master data to simplify maintenance of complex models

- Reconciling results to financials, by embedding charts of accounts

- Optimizing profits and cash flow, not just costs

-

-

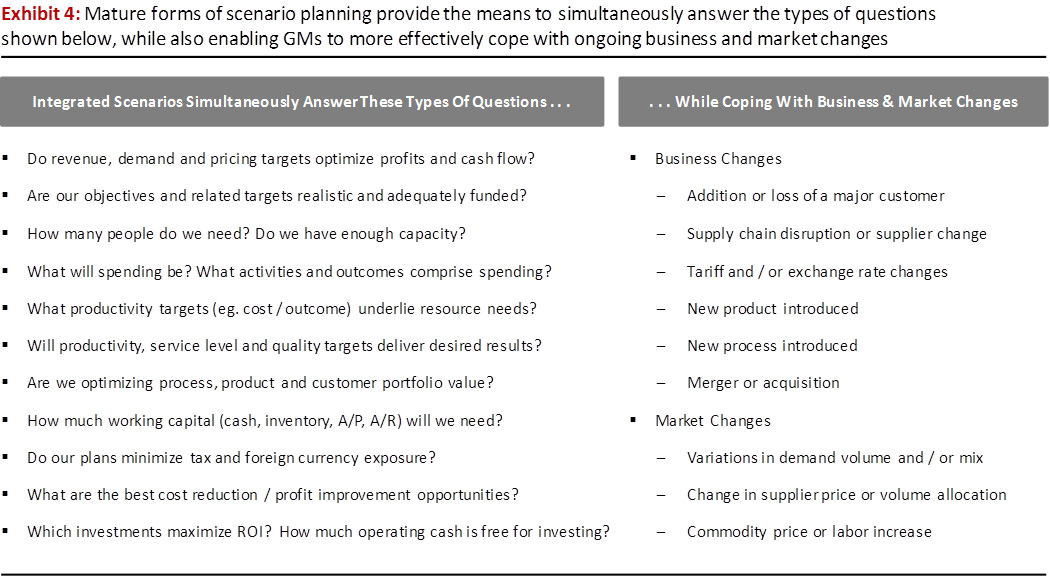

What results are planning processes that can answer the types of questions shown below in Exhibit 4, while quickly and easily coping with business and market changes.

When SFO processes are fully integrated, these questions can be simultaneously answered as part of a single process. What’s more, scenario results can be quickly incorporated into continuous planning and forecasting processes where there is no distinction between rolling forecasts and S&OP. Integrated scenarios is a term I use to describe such capabilities. At this point, manufacturers achieve “One Version of the Truth”, on both a forward- and backward-looking basis.

Further evidence of immature planning models can be found in cash flow forecasting which, despite using financial planning and budgeting tools, remains one of the most problematic challenges. What’s not always appreciated is that the models required for supply chain planning are the same ones required for mature cash flow forecasting, especially since cash optimization should be an output of scenario planning.

Cash flow forecasting accuracy is one of leading indicators of effective IBP processes

Mature processes and solutions, on the other hand, recognize that cash flow forecasting accuracy is one of leading indicators of effective IBP processes. And that the best way to achieve this is by having one enterprise model that is shared by finance and operations, across a single work flow-enabled process. In fact, the absence of such integration is one of the primary reasons why CFOs struggle to establish more strategically focused processes.

Capability 4: Concurrent Processes

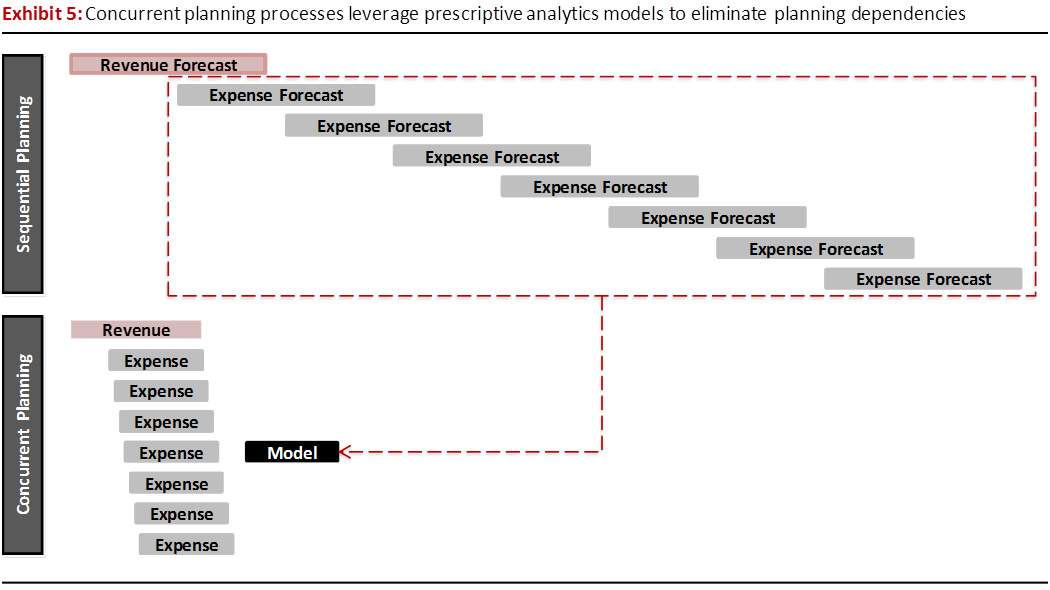

When planning and performance management is fragmented, process tend to be more sequential. This means that one activity cannot be started until another is finished. These processes tend to be longer and more time consuming.

Concurrent planning processes enable planning activities to completed simultaneously. They provide the means to collapse planning cycle time by eliminating dependencies between planning activities that are caused by fragmented models and processes. Specific integration points support such reductions, including:

-

-

-

-

- Financial & non financial measures & targets

- Planning & performance management

- Upstream & downstream activities

- Target setting & resource allocation

- Functions & business processes

- Outcomes & business processes

- Profits & cash flow

- Ongoing operations & strategy

-

-

-

Immature IBP lack these integration points. Without them, they can’t collapse planning cycles, as depicted below in Exhibit 5.

Summary

Collectively, these capabilities are the key ones that separate immature and mature forms of P&PM / IBP processes. They are described in further detail in the YouTube video shown below.

I welcome comments and opportunities to discuss these points of view. To this end, please feel free to connect with me and join the IBP Collaborative LinkedIn group, a key focus of which is on planning and performance management innovations and interconnected (strategic, financial and operational) issues in companies that manufacture and distribute goods. Also, check out our YouTube Channel for further details about the perspectives contained in this and other LinkedIn posts.